Best Platforms to Trade Futures for Forex

When it comes to choosing one of the best platforms to trade futures, there are a few key factors you’ll want to consider to make sure you pick an option that fits your needs and experience level. Futures can be an exciting way to diversify beyond forex, but it’s important to trade on a platform you find user-friendly. Some of the major things to look at include your familiarity with futures markets, what trading style and frequency works best for you, and how much hand-holding you need when first getting started.

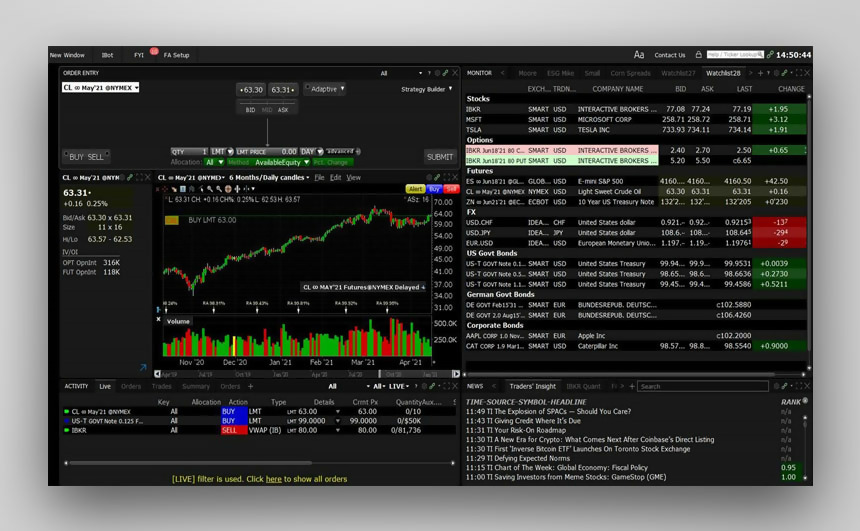

Interactive Brokers – The Big Dawg Platform

When it comes to best platforms to trade futures, it’s hard to ignore big bad IBKR. This platform has been around forever and is known industry-wide as THE spot for professional-level futures trading. They offer access to pretty much every futures market under the sun across multiple exchanges. The platform itself is super robust with tons of advanced order types, analytics, and backtesting tools to satisfy even the most tech-savvy trader.

Now, IBKR definitely isn’t for the amateur trader just dipping their toes in. There’s a pretty steep learning curve and the margins are higher than other options. But if you’re a more experienced forex trader looking to start scaling up your futures game. IBKR will give you the muscle under the hood to do it in a big way. The commissions are also very reasonable for higher volume traders. All in all, it’s one of the premier best platforms to trade futures and worth checking out if you’re getting serious about futures.

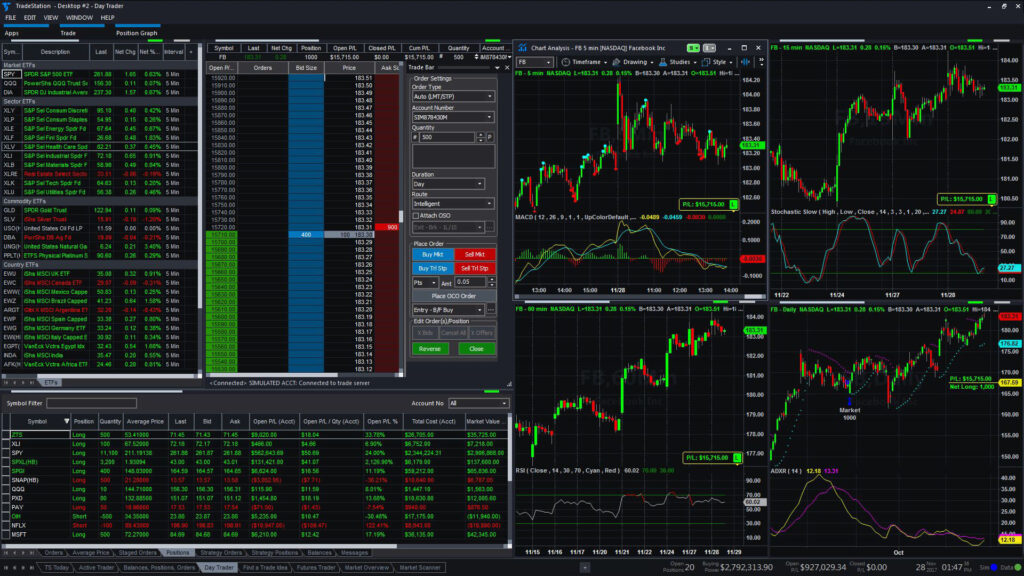

NinjaTrader – A Solid All-Rounder

Another great platform to trade futures that’s popular with forex traders moving over is NinjaTrader. The platform is very robust but also super user-friendly. It’s got a great desktop interface for active trading alongside mobile apps so you can take the party on the road. Charting and market scanning tools are top-notch too.

When it comes to futures specifically, NinjaTrader really shines. Margins are ultra-low, especially for intraday positions. Commissions are also dirt cheap, starting at just $0.35 per contract. You can easily trade futures on here without breaking the bank. The platform also integrates well with other brokers via API if you want to trade forex through them while using NinjaTrader for futures. Overall it offers great bang for your buck and is easy to use, making it a solid choice for beginner futures traders transitioning from forex.

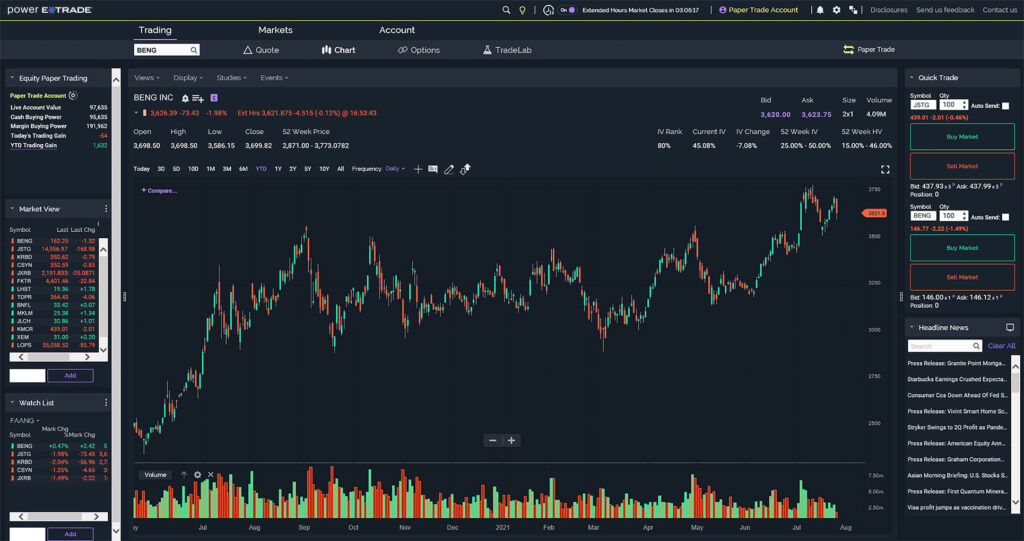

E*TRADE – Great For Newbies

If you’re just dipping your baby toes into futures trading, I’d recommend looking at E*TRADE as one of the best platforms to trade futures. They have super low barriers to entry with $0 minimums to open an account. The platform is very beginner-friendly across desktop, web, and mobile. It integrates futures nicely alongside other assets like stocks, ETFs, and options if you also want exposure there.

What I really like about E*TRADE for new futures traders is their education resources. They have TONS of great tutorials, videos, and articles to help novice traders learn the ropes before putting real money on the line. This includes futures-specific content on markets, strategies, risk management, and more. So it takes a lot of the learning curve out of the equation. Commissions are reasonable too, especially if you’re just paper trading to start. Overall I think it’s a solid starter platform for getting your feet wet in futures.

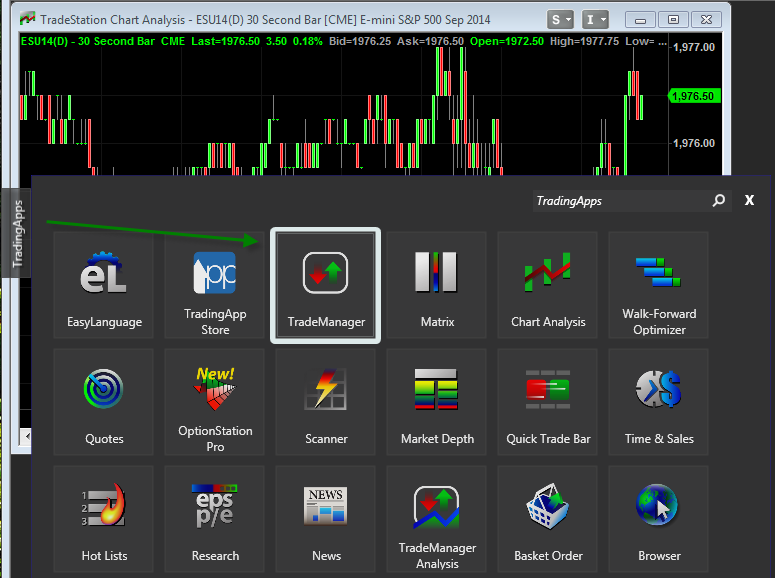

TradeStation – Advanced Tools For Grownups

If you’ve been trading forex for awhile and feel like you’ve outgrown platforms like E*TRADE, take a look at TradeStation as one of the best platforms to trade futures. This platform is aimed more at advanced/professional traders. The interface is sophisticated with powerful charting, automated trading tools, and direct access to multiple futures exchanges globally.

Where TradeStation really stands out though is its advanced order types and trade automation abilities. This lets more advanced traders code and backtest complex strategies involving futures. You also get much lower margins than other brokers if you trade futures frequently. The downside is it does have a steep learning curve and isn’t as beginner friendly as some other options. But if you’re an experienced trader looking to up your futures game, TradeStation gives you all the big boy tools to get creative with your strategies.

Considering Your Experience Level

When choosing one of the best platforms to trade futures, the experience level you bring to the table is an important factor. If you’re just starting out in futures, a user-friendly platform with educational resources like E*TRADE may be your best fit. But more advanced traders have different needs, so a powerful platform with advanced tools like TradeStation could be a better choice. Be honest with yourself about where you stand experience-wise to pick a broker that supports your current skill set and learning goals.

Cost Comparison Between Platforms

Naturally, no one wants to pay more than they have to – especially when dipping their toes in a new market. To find one of the most cost-effective platforms to trade futures, do your research on variables like minimum account sizes, commissions, and margin requirements across different brokers. Low costs are great for beginners, but advanced traders prioritize functionality. Understanding the full cost structures involved can help ensure you get a platform that fits your budget and trading style.

Final Thought

Whether you’re just dipping your toes in futures or looking to take it to the next level, these platforms – Interactive Brokers, NinjaTrader, E*TRADE, and TradeStation – represent some of the very best platforms to trade futures out there. Consider your experience level and needs, then evaluate which platform aligns best before taking the plunge. Remember – futures can be risky due to leverage, so be sure to use proper risk management as well.